In response to this pressing need, the pioneers of Prolycator set out a mission to redefine the way people access investment education. Prolycator is a global solution that’s all about convenience and personalized services.

The goal is to have people appreciate the complexities and uncertainty of investing before they buy any asset – the reverse is the prevalent case today. With this vision, Prolycator was born, a website that serves as a bridge, connecting users to suitable investment education firms without charging any fee.

Prolycator ensures that language barriers do not hinder access to suitable investment education. The website connects users with education firms that provide in-depth training in their preferred language.

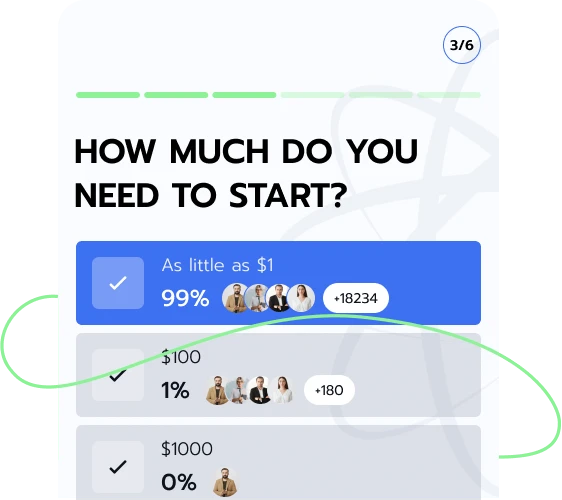

Getting started with investment education shouldn’t be a herculean task, and Prolycator recognizes that. Prolycator is designed for the average person, removing the usual barriers to financial literacy. No matter the level of one’s experience in the investment world, Prolycator simplifies the process of finding a suitable education firm that matches individual needs.

Users can begin their journey toward understanding the financial world without unnecessary delay. Why not register to learn more?

Prolycator understands that every learner has unique needs or preferences when it comes to acquiring investment knowledge.

The diversity of educational resources available through the education firms allows individuals to explore different aspects of investing at their own pace. Prolycator supports the idea that anyone, regardless of their background, can embark on a journey towards financial literacy.

Registering on Prolycator is a straightforward process designed to link individuals to investment education firms. Registration is quick and only requires a full name, email address, and phone number. Once registered, users are matched with a suitable investment education firm.

After registration, Prolycator facilitates the connection to the selected investment education firm. Users will have free access to the appropriate educators who shed light on the nuances of investment and finance.

Upon being assigned to an investment education firm, a representative of the firm will reach out to the user for onboarding. This representative will take the time to discuss interests and preferences, ensuring that the educational experience is in line with the individual’s learning goals.

Prolycator does the job by directly connecting the average person with investment educators. These partners equip these users with the knowledge and skills they require to make sense of the nuances in the investment world.

Every investor is different; that’s why markets move. Each comes to the market with a unique perspective, strategies, and goals. If two people are shown the same price chart, the odds are that each person would see something quite different. Risk tolerance or perception also differs among investors. One of the key steps before making an investment is understanding risk tolerance.

Risk tolerance, which varies based on age, financial situation, investing objectives, and personal features, is the amount of loss an investor can bear when choosing an investment project. Some investors are naturally more comfortable taking more risk than others. Sign up for Prolycator to explore this further.

Investors are usually classified according to how much risk they can tolerate. The categories are based on many factors, each representing a different degree of risk an individual may be comfortable with. Connect with suitable educators via Prolycator to learn more.

Aggressive

Aggressive investors are those who are well-versed in the market and take huge risks. Such types of investors are used to seeing large upward and downward movements in their portfolios.

Moderate

These types of investors are relatively less tolerant when compared to aggressive investors. They take on some risk and usually set a percentage of losses they can handle.

Conservative

These investors are the most risk-averse. They prefer stability and often choose assets or markets with minimal volatility, such as Bonds and dividend-paying stocks.

Investing is more than just hitting the “buy” button on an asset; there’s a psychological component to it. Investors have to first look within before they leap. Get more information on this by registering on Prolycator.

This is a critical consideration every investor should have before making a move. This helps investors know the period for which they’re fine with being illiquid. Investment objectives and risk tolerance both depend on the time horizon. People who invest for a long time tend to be more risk-tolerant and have the ability to pursue aggressive investment strategies. This is because they have the advantage of time, which might place things in their favor. Learn more by signing up on Prolycator.

This form of investment is essential to the global food supply chain, a sector that is becoming more and more significant as a result of a rising world population and increased need for food resources.

Crop rotation, organic farming, and the creation of renewable energy sources like biofuels made from agricultural goods are all commonly supported by agricultural investments as environmental consciousness evolves. Deeper insights on this approach can be obtained after registering on Prolycator.

The rate at which the standard rate of prices for goods and services increases, reducing purchasing power, is called inflation. On the other hand, an inflation hedge is an investment that may shield investors against the decrease in the currency's purchasing value brought on by inflation. Learn all about inflation metrics by registering for free on Prolycator.

The investments either remain the same or increase during inflation cycles. The idea is to choose assets that will either appreciate, outpace inflation, and thereby preserve the real value of the initial investment. Possible inflation hedge investments include:

Real estate may be a more reliable hedge against inflation than financial instruments since its value is usually less affected by sudden changes than financial instruments that are vulnerable to market volatility. Register on Prolycator and learn more.

Another popular option for shielding against inflation is commodities. These consist of agricultural products, natural gas, oil, and precious metals. They are an appealing choice for investors wishing to preserve their ability to spend because their prices typically rise in line with inflation. Sign up on Prolycator to gain knowledge on the different types of investment and the level of risks attached to each.

The two major ways that stocks could protect against inflation are through dividend payments and long-term bullish moves. Although short-term market fluctuations are possible, historically, stocks have offered long-term earnings that may exceed inflation. Learn more after signing up on Prolycator.

The US Department of Treasury issues TIPS, which are government-backed bonds. As they modify the basic value to keep up with increasing costs, they introduce an inflation protection factor. Understand these concepts more after registering on Prolycator.

It allows investors to identify possible risks and seize new opportunities. It also helps them make informed decisions by allowing them to adjust to changes in their lives, careers, and the economy.

These indicators help in the analysis of price instability. The standard deviation calculates the difference between the average earnings yield of a stock over a particular period of time and its individual returns.

Risks and opportunities exist in times of volatility. For example, investors may come across buying opportunities when securities are at a discount during periods of high volatility. Why settle for guesswork? Register on Prolycator for free to connect with education firms to uncover key concepts.

An exchange-traded fund (ETF) is an investment that holds assets made up of stocks, commodities, bonds, or foreign currencies. Exchange-traded funds (ETFs) are traded like stocks at different prices throughout the trading day, in contrast to mutual funds, which are normally traded once a day. Investors in these funds do not directly own the core investments but instead have an indirect claim and are entitled to a portion of return and residual value in case of fund liquidation. Discover more by signing up on Prolycator.

These trusts are a particular kind of closed-end investment portfolio that invests in commonly traded firms' equities. They might concentrate on particular industries, such as healthcare or technology. Keeping tabs on these helps address investors’ needs and align with their risk appetites. Learn more after using Prolycator.

These trusts invest in bonds and other fixed-income securities that may pay investors fixed interest or dividend payments until they are matured. At maturity, investors may be repaid the principal amount that they originally invested. Learn more about this after registering on Prolycator.

Investment in real estate properties and real estate-related securities takes place in these trusts. They aim to make an income by acquiring and developing properties. Sign up on Prolycator.

This is a combination of equity and fixed-income investments. These trusts seek to balance risk and return. They provide diversification advantages while maintaining exposure to different asset classes. Register on Prolycator to learn more.

This kind of trust concentrates on certain strategies, like social investing or specialized sectors. They assist investors who are searching for certain investment opportunities. After registering on Prolycator, education firms will provide more information about these strategies.

By investing in assets from certain regions or worldwide, these trusts give investors access to global markets without demanding them to handle foreign investments directly. Gain more insights by signing up for Prolycator.

Connecting with education firms through Prolycator facilitates the journey of learning and discovery in the investment world. Use Prolycator and gain financial literacy.

| 🤖 Cost to Join | Sign up at no cost |

| 💰 Service Fees | Absolutely no charges |

| 📋 Enrollment Process | Quick and easy sign-up process |

| 📊 Learning Areas | Training on Crypto, FX Trading, Equity Funds, and More |

| 🌎 Regions Served | Serviceable in almost all nations but not in the USA |